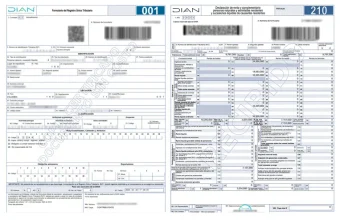

Income tax calculation and filing for individuals in Colombia.

Yes. If you are considered a tax resident in Colombia (i.e., you stay in the country for more than 183 days in a calendar year), you are required to file an income tax return.

As of 2025, foreign pension income is tax-exempt up to 1,000 UVT per month (which equals $47,212,000 COP annually, or approximately $11,800 USD at a rate of 4,000 COP/USD). If your monthly pension exceeds this limit, the excess may be subject to income tax in Colombia.

Even if you do not owe taxes, you must still file a return if you meet other reporting thresholds related to income, assets, or financial transactions.