Table of Contents

Navigating the social security system in a new country can be complex, and Colombia is no exception. For foreigners living or working in Colombia, understanding the intricacies of its social security system is not just beneficial but often mandatory. This comprehensive guide will delve into the essential components of social security in Colombia, clarify key terminology, and highlight important responsibilities and potential risks for foreign residents, ensuring you are well-equipped to contribute to and benefit from the system effectively.

What is Social Security in Colombia?

The Comprehensive Social Security System in force in Colombia was established by Law 100 of 1993 and brings together, in a coordinated manner, a set of entities, norms, and procedures to which individuals and the community can have access, with the primary purpose of guaranteeing a quality of life that is in accordance with human dignity. It is part of the Social Protection System along with labor protection and social assistance policies, norms, and procedures.

At its core, the Colombian Social Security system operates through a series of mandatory contributions made by both employees and employers, as well as by independent workers. These contributions are directed towards distinct sub-systems, each responsible for managing specific types of benefits. The overarching goal is to mitigate the financial impact of events like illness, disability, old age, unemployment, and work-related accidents or diseases.

Understanding the intricacies of the Colombian Social Security system is crucial for anyone living, working, or considering retirement in the country, because it impacts access to healthcare services, determines future pension entitlements, and provides vital support in the event of unforeseen circumstances.

What is included in the Social Security System in Colombia?

This system is composed of three fundamental pillars: health, pensions, and occupational hazards, each with its own specific entities and regulations and also applicable to expatriates residing and working in Colombia.

Health Component

Firstly, the health component, managed by the Health Promotion Entities (EPS), is crucial. The EPS are responsible for enrolling users, including foreigners who settle in the country, and ensuring access to health services through a network of Healthcare Providing Institutions (IPS).

This subsystem operates under the principle of solidarity, where contributions from affiliates and the State finance medical care, aiming to ensure equitable access to services such as medical consultations, hospitalizations, medications, and surgical procedures. Coverage is universal and mandatory for all dependent and independent workers, as well as for retirees, and it also extends to their beneficiaries.

Pension Component

Secondly, the pension system seeks to protect workers and their families against contingencies arising from old age, disability, and death. In Colombia, there are two main regimes: the Solidarity Regime of Defined Contribution with Defined Benefit, mainly managed by Colpensiones, and the Individual Savings Regime with Solidarity, managed by private pension funds.

The contributions made throughout the working life determine the right to a pension, either by meeting the age and weeks of contribution requirements or by accumulating enough capital in the case of the individual savings regime. This pillar is vital for ensuring economic security in retirement or in situations of permanent disability.

ARL Component

Finally, the ARL (Occupational Risk Insurer) is responsible for preventing, protecting, and caring for work-related accidents and occupational diseases. The ARLs are entities that manage the General System of Occupational Risks, providing promotion and prevention services, as well as medical care and rehabilitation for workers who suffer an accident or illness related to their work activity. They are also responsible for recognizing and paying the economic benefits arising from these contingencies, such as temporary disability subsidies, compensation for partial permanent disability, or disability and survivor pensions.

Enrollment in an ARL is mandatory for all employers and their workers, including expatriates with employment contracts in Colombia, thereby ensuring comprehensive support against the inherent risks in the workplace.

What Are the Social Security Responsibilities for Foreign Residents in Colombia?

If you are a foreigner but reside in Colombia and have a Cédula de Extranjería, you must remember that under Law 100 and Decree 064, you are legally responsible for contributing to social security in Colombia through the contributory system.

This regime covers all employees, independent workers, and pensioners. The family group that depends economically on the holder may also be included as beneficiaries.

Regarding independent workers, this includes income obtained from activities such as:

- Rentals

- Financial returns

- Dividends

- Profits from the marketing of goods and services

- Fees, commissions, and/or services provided

It is important to clarify that even if the foreigner has private international health policy or is affiliated with the health system of his or her country of origin, he or she is NOT exempt in Colombia; it is his or her duty to be affiliated with the Colombian system and make the corresponding payments to social security within the terms of the law.

As a foreign national, am I required to contribute to a pension in Colombia?

As a foreigner residing in Colombia, it’s crucial to understand your obligations regarding pension contributions. The general rule, outlined in Law 100, Article 15, paragraph 2, states that foreigners who are in the country due to an employment contract and are not covered by any pension scheme in their country of origin or any other country, must contribute to a pension in Colombia.

However, there are two important exceptions and conditions to consider:

- If you are a foreigner working in Colombia under an employment contract and can demonstrate that you are already affiliated with a pension scheme in your country of origin or any other country, you are not obliged to contribute to a pension in Colombia. This provision recognizes the importance of avoiding double contributions and ensures that individuals are adequately covered. To claim this exemption, you will typically need to provide official documentation from your foreign pension fund.

- Even if you are already affiliated with a pension scheme in your country of origin or another country, you still have the option to voluntarily affiliate and contribute to a pension in Colombia.

As a foreign retiree, can I join the EPS?

Regarding pensioners, it is essential to note the provisions outlined in Resolution 5477. According to this resolution, pensioners are not permitted to enroll in the health system. Even if an EPS (Health Promotion Entity) allows for their enrollment, it is essential that foreigners understand the stipulations of Article 77, particularly regarding the validity periods specified in Resolution 5477, which explicitly prohibits such enrollment. Instead, foreigners seeking a visa must have a health policy that provides coverage within the national territory at the time of their application, as mandated by paragraph 4 of the same article.

Get a Travel Health Policy with 3 Years of Coverage

Ensure your stay in Colombia with a health policy that includes the coverages required by the Ministry of Foreign Affairs.

🔹 Comprehensive medical coverage

🔹 Repatriation and emergency assistance

🔹 Valid for visa

What is the IBC, and Other Terms for Understanding Social Security in Colombia?

This glossary of essential terms provides a clear and concise understanding of the key concepts necessary to navigate the Colombian Social Security System, especially for foreigners.

IBC:

It is important to be clear about the «Ingreso Base de Cotización» (IBC) according to your specific case to know how much you must contribute or pay. In Colombia, IBC stands for “Ingreso Base de Cotización” (Base Contribution Income). It is the value on which contributions to social security and parafiscal charges for an employee, whether dependent or independent, are calculated. This value is not always equal to the earned salary, as it may include or exclude certain concepts according to regulations. It determines the amount of money allocated to:

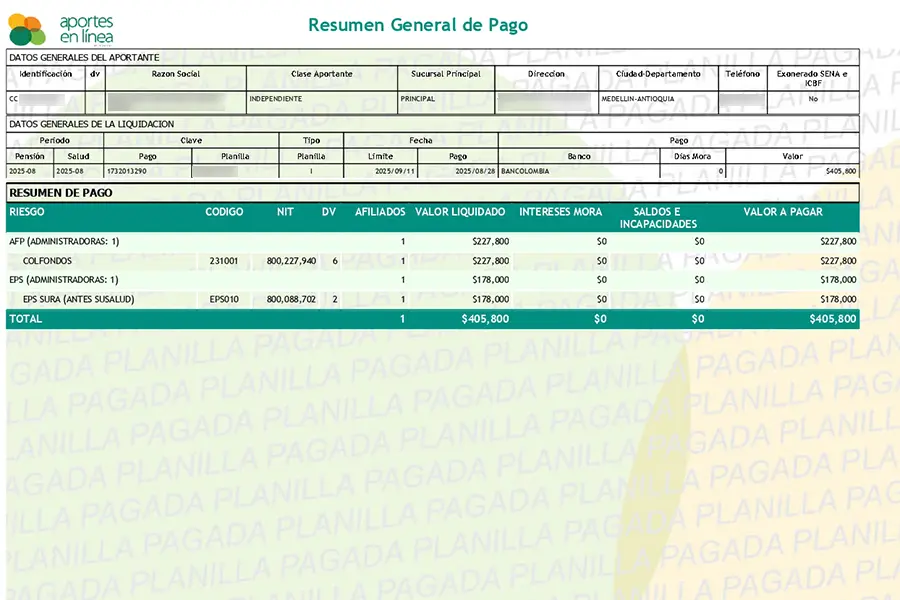

Payroll (PILA)

It is the monthly format for paying your contributions, which is managed by platforms such as Miplanilla.com, Aportes en Línea, Simple.co, and SOI. You can also use platforms such as SUAPORTE de Enlace Operativo

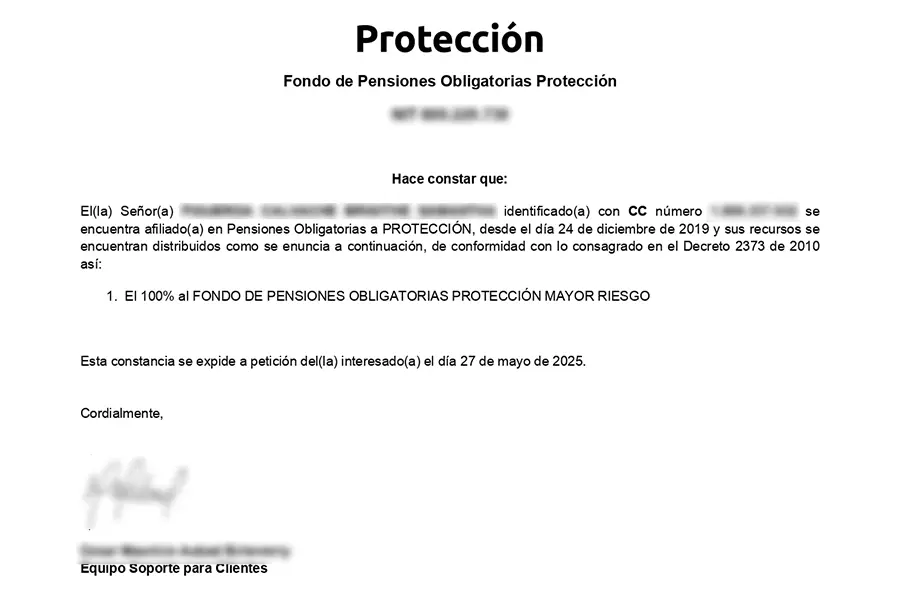

EPS Affiliation Certificate

Document that confirms your EPS, your status (“active”), and date of affiliation.

NOTE: Within this certificate, it is necessary to differentiate between the two categories for which you would be registered:

- Contributor: a person who pays into the system.

- Beneficiary: a dependent (spouse, children) who benefits from the coverage.

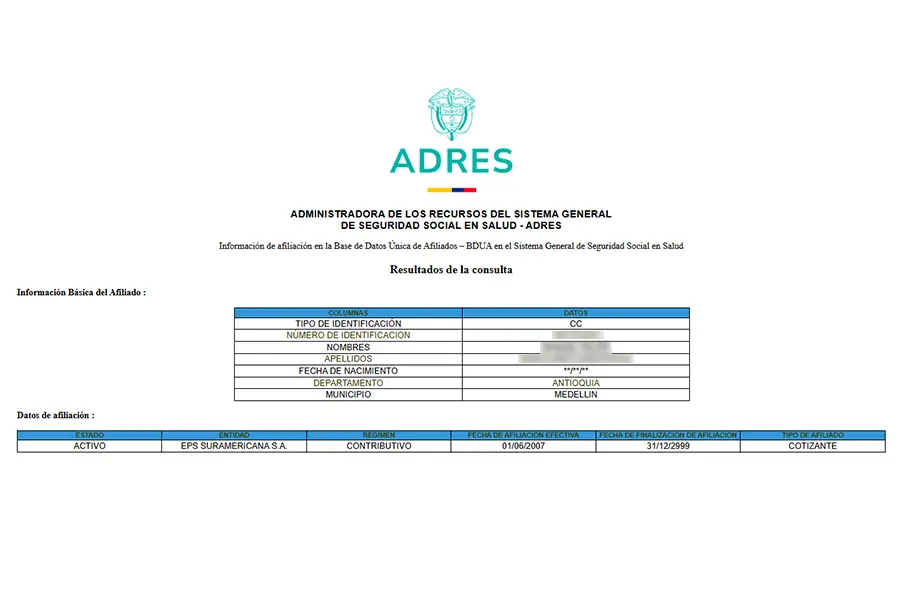

ADRES

In Colombia, ADRES stands for Administrator of the Resources of the General System of Social Security in Health. It is a public entity, attached to the Ministry of Health and Social Protection, responsible for managing the financial resources of the Colombian health system. Its primary function is to manage the collection, recognition, and disbursement of resources allocated to the provision of health services. It also allows you to verify that your health policy affiliation is active.

How much should I contribute to Social Security as a worker?

In Colombia, the total health contribution percentage is set at 12.5%. Foreigners with fixed or indefinite contracts are required to contribute 4% of their salary to the health system, while their contracting company covers the remaining 8.5%. Regarding occupational risks, the company is responsible for covering the full percentage of ARL (Administradora de Riesgos Laborales), with the rate varying based on the specific work activity and its associated level of risk. Additionally, foreigners who do not possess a pension in their home country or who choose to contribute voluntarily to the Colombian pension system must contribute 4% of their earned salary. The contracting company then contributes the remaining 12%, resulting in a total mandatory pension contribution of 16%.

Which should be the base of contribution to the SGSS?

Elizabeth is a foreigner who ABC Colombia hired as a software engineer. She has a two-year full-time contract and earns a monthly salary of $7,000,000. Since she does not have a pension in her home country, she is required to contribute to a pension. The following example shows what contributions are made to the Colombian social security system.

The employer is responsible for enrolling the worker in the SGSS, and the contribution base (IBC) should always correspond to the real salary earned by the employee—in this case, $7,000,000.

| Item | IBC Salary | Company Contribution | Worker Contribution | Total Contribution |

|---|---|---|---|---|

| EPS | 7.000.000$ | $7,000,000 x 8,5% =595.000 COP | $7,500,000 x 4% = 280.000 COP | 875.000 COP |

| Pension | 7.000.000$ | $7,000,000 x 12% = 840.000 COP | $7,000,000 x 4% = 280.000 COP | 1.120.000 COP |

| ARL | 7.000.000 | Contribution rate by risk level (0.522% - Level I)= 36.542 COP | 0 COP | 36.542 COP |

How much should I contribute to Social Security as a self-employed?

To calculate the IBC (Base Income Contribution) as a self-employed, freelancer, and also under a service contract, you need to follow a few steps: first, identify your activities and total income from all sources, both in Colombia and abroad. Next, determine any associated expenses, which can be subtracted from your total income to find the IBC. Note that contributions to the General Social Security System are your responsibility, calculated using the Integrated Contribution Settlement Form (PILA) at specified rates: 12.5% for health care, 16% for pensions (not mandatory for foreigners), and a variable rate for occupational risks (also not mandatory for foreigners). Ultimately, the IBC is set at a minimum of 40% of your net monthly income, minus applicable costs and expenses, ensuring that your contributions can only increase from that baseline.

Remember that the amount cannot be less than the current legal minimum wage, which for 2026 is $1.750.905 COP.

Keep in Mind

Remember that as an independent contractor or under a service provision contract, you are responsible for all of the IBC earned according to your income in the country.

How much should I contribute to Social Security as a foreign married to a Colombian?

In this case, for a foreigner who is married to a Colombian and does not engage in any economic activity in the country, and has no personal income abroad, it is still required that the foreigner be enrolled in the Colombian Social Security System (SGSS). However, because the foreigner has a spouse who is already covered by the contributory scheme, they can be considered a beneficiary within the family group.

The procedure to be followed is to register the status as a beneficiary in the system by presenting the Marriage Certificate, which states the relationship with the holder. This affiliation of the beneficiary does not incur any additional cost and will be covered by the fee previously contributed by the Colombian spouse to the SGSS.

What Happens if I Have My Own Income but Am Registered as a Beneficiary Under My Partner?

These could be risks you might face:

Evasion of Contributions and Penalties

Loss of Beneficiary Status

Problems for the Affiliated Partner

Lack of Accumulation of Weeks/Contributed Weeks for Pension

Vulnerability to Eventualities

These are the recommendations we suggest you follow:

Affiliation as an Independent Contributor

Transparency with Authorities

Long-Term Financial Planning:

What are the consequences of paying an IBC lower than the real income you receive?

Paying a Contribution Base Income (IBC) that does not match your actual income can lead to serious consequences for a foreigner in Colombia. Not only could it negatively impact future residence visa applications (type R), but it could also affect renewals of type M visas and the accumulated time for permanent residency. The government may consider this a negative point, requiring corrections to payrolls over extended periods (even from six months or more), which results in high costs due to the payment of the owed differences. This situation not only involves a significant financial burden but also the risk of inadmissibility for both the R and M visas, as the Ministry can request these payments and corrections at any time, covering the entire period of contributions or a specific period determined by the authority.

Most foreigners register with a third party, often asking lawyers or accountants for help, who then take charge of social security payments. From our experience, we have noticed that many people treat the issue of social security contributions for foreigners as if it were a contribution made by a local, a national who only pays based on the current legal minimum wage, unaware that foreigners are not eligible to do so. It is important that if you seek legal advice in this case for a third party to handle social security payments, they have full knowledge of the law and that payments are made according to the income each foreigner has and not based on a minimum wage.

Contact expatgroup.co and Get Professional Advice

If you have questions or need expert advice on immigration, business, real estate, or legal matters, click the button to get in touch with us.

What Are the Risks and Recommendations when Contributing to Social Security in Colombia as a Foreigner?

It is essential that foreigners residing in Colombia understand the implications and risks associated with contributing to social security, especially in situations that may generate inconsistencies or legal risks. Below, two common scenarios are detailed with their respective risks and recommendations:

What Happens if I Am Affiliated with EPS but Contribute Below the Colombian Minimum Wage?

These could be risks you might face:

Insufficient Coverage and Benefits

Legal Problems and Sanctions

Inconsistencies in Employment and Pension History

Perception of Illegality or Informality

These are the recommendations we suggest you follow:

Declare Real Income

Accounting and Legal Advice

Regularization of Contributions

Understand the Social Security System

In both scenarios, the key is transparency, compliance with regulations, and seeking professional advice to avoid legal problems and ensure adequate social security coverage in Colombia. Informality in contributions, although it may seem like a short-term saving, carries significant risks that can have serious financial and legal consequences.

Get a quote now

We offer expert guidance on immigration processes, business opportunities, housing, and investment, ensuring you have all the resources for a successful and smooth transition to life in Colombia.

Comments

Share your experience or question.

Your comment could inspire and help others who dream of living in Colombia.

24 Responses

I very much want to understand – M/R visa AND reside in Colombia. I have an R, but I live in the United States 300 days per year. I have health policy in the United States that I pay >$12000 USD per year for. Is it truly the case that I need to pay 12.5% of my income for EPS when I am here only 60 days per year, and not consecutively at that!

Colombians living abroad are excepted from EPS. Is there not an equivalent for visa holders living abroad?

Are you considered a freelancer in Colombia if you are employed by a foreign company (a US company) and work remotely in Colombia while being a foreign residen (with an M-vissa)?

Is there a maximum health contribution? or is it always12.5% of 40% of your income?

Hi my friend! I wish too say that this article is awesome, nice written and come

with approximately all vital infos. I would like to see more posts like this

.

Feel frwe to visit my blog post; Listopad

Hello!

I have a cédula de extranjería. I have been living in Colombia since 2013. For the last yearI have been a beneficiary of my wife of the Eps and pension. In January I have to apply to renew y visa, would that affect my visa renewal?

Thanks in advance for your answer

So, non-employed foreign pensioner must pay health but NOT social security?

“If you are a foreigner, but you reside in Colombia…”

Is “reside in Colombia” defined?

E.g. stay in Colombia greater than 180 days? Own a home in Colombia and live there at least one day per year?

In the article you speak of mandatory affiliation for visa M and visa R. Where exactly can I find that people with visa V are exempt from this rule? In de decretos I can only find that residents should be affiliated, but I cannot find the definition of a resident. For example, visa V wouldn’t be a resident according to migración, but according to DIAN I am a resident: what is the definition of a resident according to the ministerio de la salud?

Short version: may they deny my application for visa M, if I had visa V and don’t have an eps, while I did make enough money to contribute (foreign income)?

I very much want to understand – M/R visa AND reside in Colombia. I have an R, but I live in the United States 300 days per year. I have health policy in the United States that I pay >$12000 USD per year for. Is it truly the case that I need to pay 12.5% of my income for EPS when I am here only 60 days per year, and not consecutively at that!

Colombians living abroad are excepted from EPS. Is there not an equivalent for visa holders living abroad?

Hi, Philip. The Freelance Visa is for workers who may have remote contracts. Still, it is also important that they have employment/contract with a Colombian company. On the other hand, it is always the same contribution percentage.

Contact us to solve all your doubts if you want specialized advice.

+18507714928

Or schedule an appointment with an advisor.

https://expatgroup.tech/book-an-appointment/

Have a great day!

Are you considered a freelancer in Colombia if you are employed by a foreign company (a US company) and work remotely in Colombia while being a foreign residen (with an M-vissa)?

Is there a maximum health contribution? or is it always12.5% of 40% of your income?

Hi my friend! I wish too say that this article is awesome, nice written and come

with approximately all vital infos. I would like to see more posts like this

.

Feel frwe to visit my blog post; Listopad

Hi Zach! Thanks for writing to us. The EPS certificate became an essential requirement for visa renewals. It is necessary first to analyze your specific case to determine if being a beneficiary of your wife will affect your future process. We recommend you book a consultation with one of our specialists: https://expatgroup.tech/book-an-appointment/. Take care!

Hello!

I have a cédula de extranjería. I have been living in Colombia since 2013. For the last yearI have been a beneficiary of my wife of the Eps and pension. In January I have to apply to renew y visa, would that affect my visa renewal?

Thanks in advance for your answer

Hi! You’re right. Most of the time, communication with EPS is difficult. If you want, write to us by email at info@expatgroup.co telling us a little about your situation and we will help you find the best solution. Kind regards!

Nobody ever explains how to compare EPS companies. EPS websites don’t have functional “click here to join” buttons. I have been waiting almost a month for a response to an email to an EPS asking for an appointment to meet with someone who can subscribe me to the plan. I went in person to two plan’s clinics and even there in person no one could tell me how to subscribe. What’s going on? What am I failing to recognize here?

So, non-employed foreign pensioner must pay health but NOT social security?

Yes can you please clarify, because as an M you only have to be in the country one day every 6 months and a R one day every 2 YEARS to keep these visas valid correct? Obviously this would not make you a tax resident if doing the minimum amount of time on the ground. How are they defining “residing”, just if you have a M or R visa or you actually physically present the 6 months? I imagine there are a decent amount of people who have residency but dont stay in colombia 100% of the time.Can you legally do the minimum amount of time (or less than 6 months to be a tax resident), have a CE, and not be a tax resident and not pay the eps? can you clarify? Also, by doing the minimum, could you still become a colombian citizen after 5 years with the R visa? THX

“If you are a foreigner, but you reside in Colombia…”

Is “reside in Colombia” defined?

E.g. stay in Colombia greater than 180 days? Own a home in Colombia and live there at least one day per year?

In the article you speak of mandatory affiliation for visa M and visa R. Where exactly can I find that people with visa V are exempt from this rule? In de decretos I can only find that residents should be affiliated, but I cannot find the definition of a resident. For example, visa V wouldn’t be a resident according to migración, but according to DIAN I am a resident: what is the definition of a resident according to the ministerio de la salud?

Short version: may they deny my application for visa M, if I had visa V and don’t have an eps, while I did make enough money to contribute (foreign income)?