Table of Contents

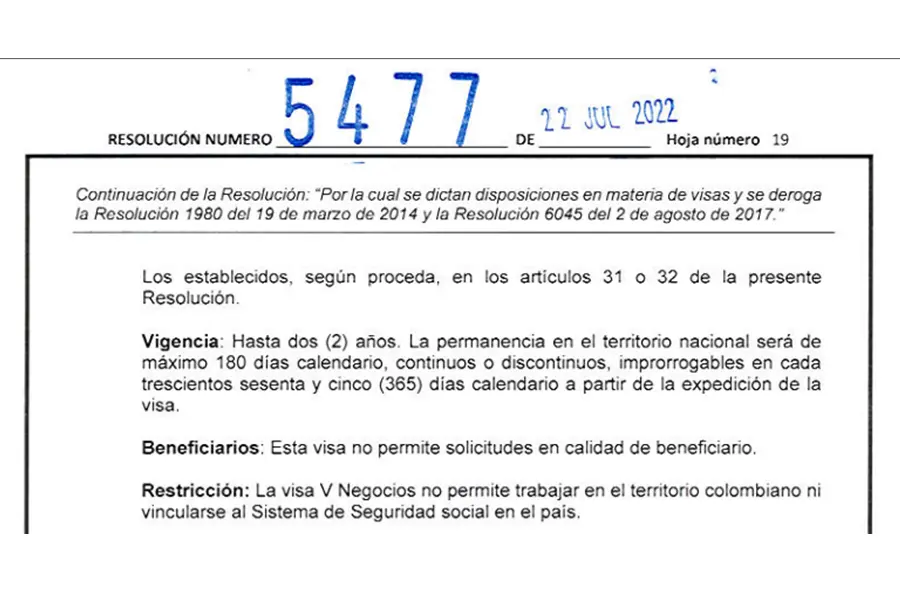

With the entry of Resolution 5477 of 2022, the requirements for Colombian visa applications, especially health-related ones, have become stricter. Foreigners applying for visitor visas (V) and some Migrant visas (M) must present comprehensive health policy that meets the requirements of Article 34, Numeral 2.

While the Colombian health system (EPS) is available to foreigners once they obtain a visa, it does not meet the health coverage requirements necessary for visa application and maintenance. Consequently, reliance on EPS could lead to inadmissibility or visa denial.

This requirement aims to ensure that individuals entering Colombia have access to adequate healthcare in case of illness or injury during their stay.

Applicants must provide documentation proving their health policy coverage as a key requirement in the visa application process. This important change underscores the Colombian government’s strong commitment to ensuring the well-being of both visitors and residents through valid health policy that meets the criteria outlined in the Resolution. Therefore, all prospective visa applicants are required to adhere to the definition of health policy provided by the Resolutions.

What are Health Promotion Companies (EPS)?

Health Promotion Enterprises (EPS) is an entity responsible for providing health services in Colombia. These entities operate under the regulation of Sistema General de Seguridad Social en Salud (SGSSS), and they have the task of enrolling individuals and families, providing them access to a wide range of medical services and healthcare.

The role of the EPS is not limited to mere enrollment; these entities are pivotal in managing and coordinating comprehensive health services for their members. They expertly handle the assignment of doctors and specialists, the authorization of tests and procedures, and the provision of medications and treatments. Additionally, they play a vital role in health promotion and disease prevention through impactful education programs and awareness campaigns.

Why is the EPS Not Valid for Applying for a Visa in Colombia?

Resolution 5477 of 2022 clearly establishes that Business Visas (V) and Retirement Visas (M) do not permit affiliation with the Social Security System. As a result, holders of these visas cannot utilize EPS as their health policy. Furthermore, even in cases where affiliation is technically possible, it is consistently denied as a requirement for the mandatory medical coverage necessary to obtain a Colombian visa, as in Digital Nomad visa applications.

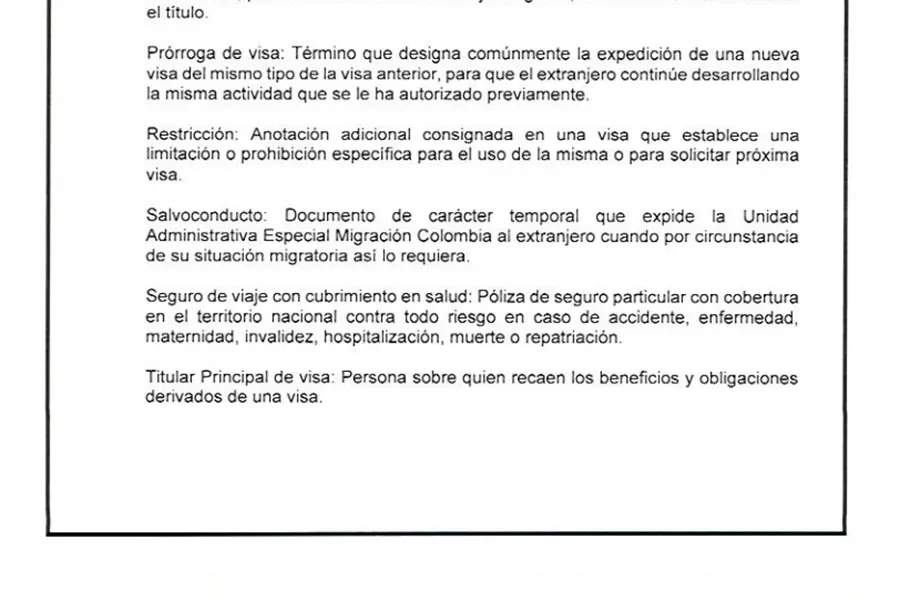

What Must a Health Policy Include to Apply for a Visa in Colombia?

Accurate health policy is non-negotiable for successfully obtaining a visa in Colombia. It is essential that this policy be international and tailored to meet the medical needs of foreigners in the country. This necessity arises from the fact that the Colombian health system and its EPS (Health Promotion Entities) are primarily structured for residents or individuals with formal ties to Colombia, such as employees or regular students. Consequently, these systems often fail to provide adequate coverage for foreigners lacking official residency status.

In light of this, Resolution 5477 of 2022 outlines specific requirements that health policies must fulfill to ensure appropriate protection:

Repatriation Coverage

This is a key aspect that EPS in Colombia do not standardly cover. Repatriation is typically linked to international or private health policy rather than regular health services.

Death Coverage

In the context of visa requirements for Colombia, death coverage clearly refers to a health policy that compensates designated beneficiaries if the insured passes away during their stay in the country. While Colombian EPS offers coverage for death resulting from accidents or illness, it does not provide the same level of protection and, in this case, compensation as a private health policy. As such, EPS policies fall short of meeting the death coverage requirements stipulated by international health policies, which deliver direct payments to beneficiaries and offer additional essential coverages.

Worldwide Coverage:

In Colombia, the EPS system offers coverage exclusively for care within the country’s borders, lacking the necessary provisions for adequate international protection. This becomes particularly critical for individuals who are temporarily in Colombia or who have not yet secured permanent residency.

Furthermore, visa application requirements stipulate specific health policy coverage, including essential global coverage, which is not met simply by enrolling in an EPS. This limitation highlights the need for comprehensive health policy solutions that truly cater to the diverse needs of expats and temporary residents.

Addressing these issues is crucial to avoid visa denial and find suitable international health policy that meets visa requirements.

Coverage for pre-existing medical conditions

In recent months, we have observed a significant rise in the additional requirements our clients face when applying for visas, particularly regarding pre-existing health conditions.

Pre-existing conditions refer to any health issues, injuries, or chronic ailments that have been diagnosed or treated prior to submitting your application for a Colombian visa. This encompasses a range of conditions, including diabetes, hypertension, cardiovascular diseases, and other health concerns that demand ongoing care, regular check-ups, medications, or medical interventions. It is crucial to provide comprehensive and accurate information about these conditions when applying for your visa. Failing to disclose complete and truthful information can lead to increased scrutiny, delays, or even the denial of your visa application.

By submitting detailed information about your health, you enable the Ministry of Foreign Affairs to properly evaluate whether your health policy fulfills the essential coverage requirements, including treatment for your specific condition and routine medical care. This transparency not only facilitates a smoother application process but also safeguards your health and wellbeing during your stay in Colombia.

Maternity Coverage

If relevant (for example, if the applicant is a woman and is pregnant or planning to have a baby), the policy must include coverage for prenatal care, childbirth, and postpartum care.

Disability Coverage

The resolution requests that the policy cover permanent or temporary disabilities due to accident or illness, including partial or total disability.

Duration of the Health Policy

To ensure applicants have access to medical care in Colombia, the Ministry of Foreign Affairs requires proof of comprehensive medical coverage as part of the visa application. This includes a valid health policy or health plan that covers the applicant for at least one year.

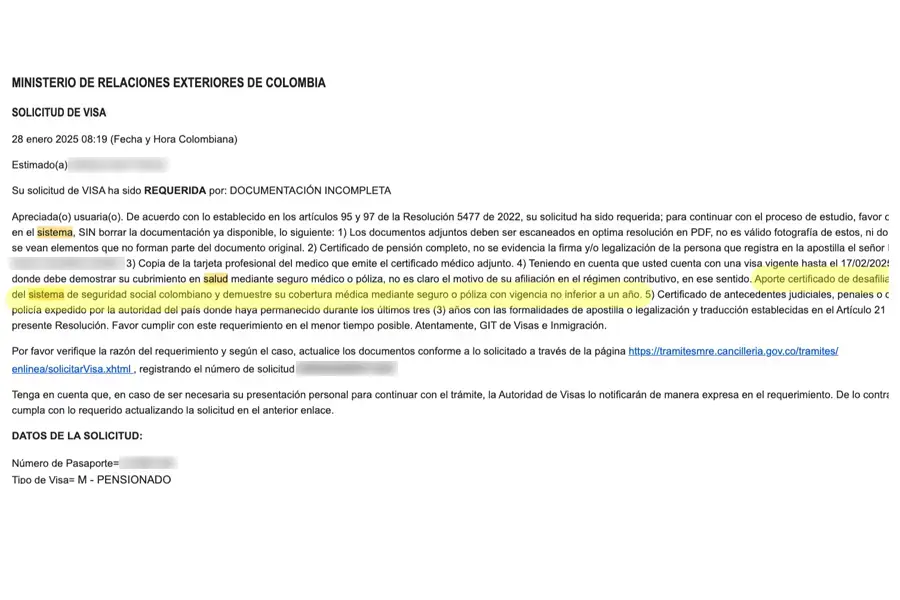

Applicants are required to disenroll from the Colombian Social Security System (EPS) as part of the visa application process. This stipulation emphasizes the necessity for each visa applicant to possess private and independent health policy throughout their stay in Colombia. By doing so, they ensure they are not dependent on the public health system, safeguarding their health needs with comprehensive coverage tailored to their individual requirements. This approach not only enhances their peace of mind but also aligns with the regulations set forth by the Colombian authorities.

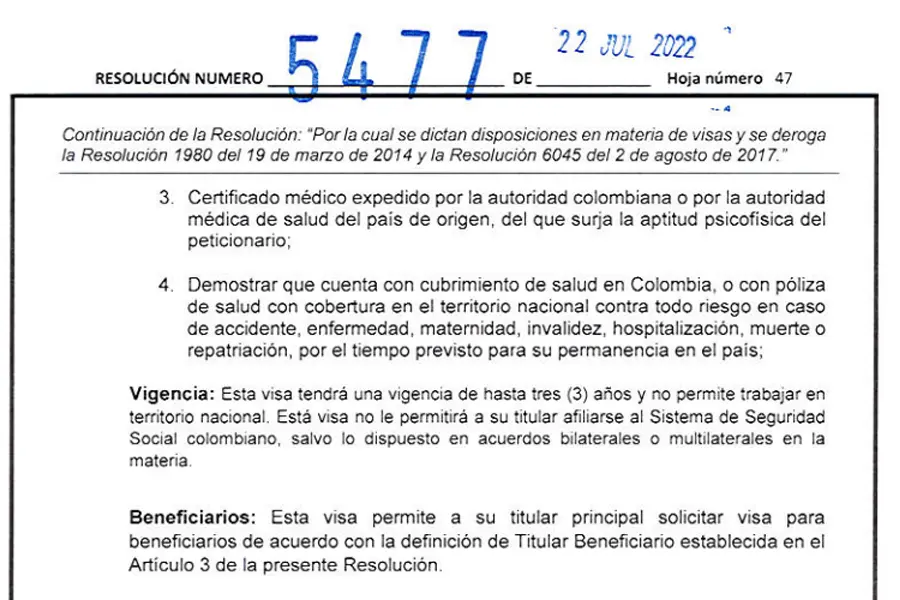

Can Foreign Retirees Enroll in the EPS in Colombia?

Affiliation with an international health policy that is valid for no less than one year is now the only type of health coverage accepted for visa applications since, according to the Ministry of Foreign Affairs, a foreigner can’t be affiliated with the Colombian Social Security System or the EPS.

In response to the ongoing requests from the Ministry of Foreign Affairs regarding the immediate disaffiliation from the Colombian Social Security System, as well as the requirement to provide proof of medical coverage through a health policy valid for at least one year, we at expatgroup.co want to underscore the importance of adhering to these directives outlined in Resolution 5477. We are committed to helping you understand that fulfilling these requirements is essential to ensure your visa application proceeds smoothly and without complications.

Viability

Resolution 5477 of 2022 regulates the procedures for visa applications and establishes the requirements for foreigners wishing to enter Colombia. However, regarding health policy, the resolution states that, for a visa application, the applicant must have medical coverage during their stay in Colombia, but it does not specify that it necessarily must be provided by a Colombian EPS.

As the Resolution states, individuals applying for the Retirement Visa and Business Visa cannot enroll in health policy. Similarly, those applying for the Digital Nomad Visa and any type V visa are now facing the restriction of not being allowed to enroll in the Health System, which necessitates obtaining a health policy as being required.

What Health Policy Would Be Ideal for a Visa Application?

In our extensive experience handling nearly thousands of visa applications, we consistently advise our clients to secure international health policy. While the Colombian Social Security System covers many applicants through an EPS, we have seen that opting for the right health policy significantly enhances their chances of visa approval. Among the myriad options available, one of our top recommendations for health policy for a visa in Colombia and that is perfectly adapted to cover all the coverages required by the Colombian goverment are the EG Assist plans. Every plan provides peace of mind and includes the specific requirements of the visa process, making them an outstanding choice for applicants.

EG Assist plans address and cover all general needs and pertinent requirements for your stay in the country, also providing specific plans for digital nomads, investors, and retirees.

Can I Buy a Health Policy from Anywhere?

You can now easily purchase online 1, 2 or 3 years of coverage for your health policy in just a few simple steps with EG Assist.

Why Choose EG Assist as Health Policy for a Colombian Visa?

The EG Assist policies are ideal for visas due to their coverage requirements by the Colombian government and international health policies. Includes features such as their quality medical centers alliances, repatriation in case of emergency or death, plans designed for every age group, coverage for pre-existing conditions, worldwide medical assistance and prescription services, and an enhanced customer experience through web. EG Assist ensures a quick response to travelers’ needs and demonstrates its commitment to excellence and customer satisfaction by providing all these benefits:

To Sum Up

Foreigners must provide international medical policy that complies with the standards set forth in Resolution 5477 of 2022 to successfully apply for a Colombian visa. It’s important to note that Colombian EPS (Health Promotion Entities) do not qualify as valid health coverage for these applications due to their inadequate coverage. Securing a comprehensive health policy from reputable international providers, such as EG Assist, is essential for a seamless visa approval process. Prioritizing the right health policy can make all the difference in navigating the visa application journey.

Comments

Share your experience or question.

Your comment could inspire and help others who dream of living in Colombia.