Table of Contents

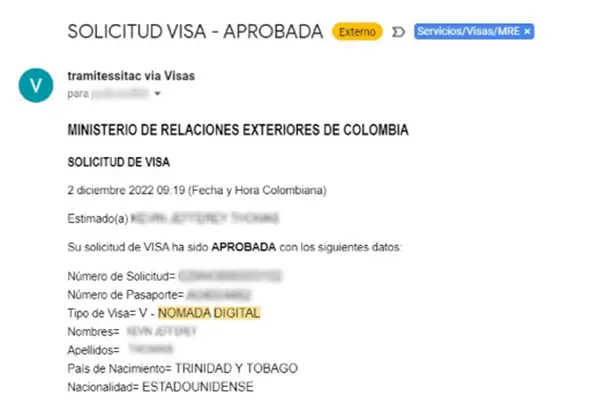

What may have started as a rumor or as something not so plausible in the expatriate community is now a reality. Expats can apply for a Colombian digital nomad visa since October 2022. Better yet, since the release of Resolution 5477 regulating visas in Colombia, expatgroup.co has been able to get more than 250 Digital Nomad Visas approved for our clients.

We have had the privilege of having successful cases from different nationalities, with different professional roles, and with processes carried out by our team that have produced satisfactory results.

Who can apply for a digital nomad visa in Colombia?

The digital nomad visa in Colombia allows applicants to live in Colombia while continuing to perform their work or academic activities remotely, as long as they meet certain requirements established by the immigration authorities. The following are the main categories of people who may apply for this type of visa:

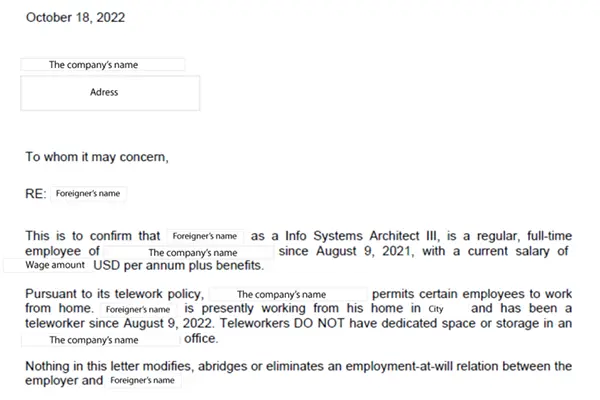

If you're a worker

An employment letter specifying that you perform remote work and the type of remuneration received. In some cases, the government also requires the telework contract and the certificate of existence of the foreign company.

If you are an owner-partner

Attaching the documents that prove it according to the country of origin, for example, the certificate of good standing, is indispensable. In addition, it is necessary to provide a letter from the company stating that you are a partner/acconist and that you develop the activities of the business remotely.

If you are an entrepreneur

A motivation letter and a structured project.

What should I know about the requirements for the digital nomad visa?

Passport

Be a passport holder with free entry to Colombia, valid passport with at least 2 blank pages and 6 months of validity

Bank statements

Bank statements with minimum income equivalent to three (3) Minimum Legal Monthly Wages in Force (SMLMV) during the last 3 months.

Apostille and official translations

All documents issued outside Colombia must have an apostille and official translation. Expatgroup offers additional apostille service USA and official translation so you can apply for the visa without any inconvenience.

Passport stamp

If you are in Colombia, send a photocopy of your passport page with the last entry stamp.

Health Insurance Policy

With coverage in Colombia against all risks. We recommend a policy with at least 1 year of coverage.

Background Check

Applicants also must provide the Background Check for the visas that require it as a mandatory document.

At expatgroup.co, we help you obtain your FBI Background Check from Colombia quickly and securely for your visa application. Click the button and get the digital background check certificate for U.S. citizens, including fingerprinting, apostille, and translation services.

What about Health Insurance for a Digital Nomad Visa?

Colombia’s updated regulations in 2022 require medical insurance for individuals with Visitor (V Type), including Digital Nomad Visa, and some Migrant (M Type), which provides extensive coverage for a wide range of potential risks, including accidents, illness, maternity, disability, hospitalization, death, or repatriation.

From this perspective, and resonating with the advice of our partner, Medellin Guru, Assist Card stands out as the best option. It provides coverage plans that fulfill all the stipulations demanded by Resolution 5477.

The best part is the convenience of purchasing your insurance online. We suggest acquiring your insurance through Assist Card, choosing your travel dates, paying virtually, and instantly receiving your insurance voucher to apply for your visa.

Do you need health insurance for Colombia Visa Applications?

Foreigner, when applying for your Colombian visa, health insurance is key. Assist Card offers you the best plans and prices to meet the medical and visa requirements.

What is the validity of the digital nomad visa?

According to Resolution 5477, the validity of this visa can be up to two years; however, the visas we have approved have been for one year, and until now, the visas do not include any restriction on the label.

We take this opportunity to remind our expat community that although, through social networks and on some websites, it has been said that a foreigner with a digital nomad visa can only stay 180 days a year in Colombia, this is not true. Foreigners who get their nomad visas may stay in the country as long as they wish, even staying for a full-time authorized visa. According to the resolution, this is a category V visa with multiple authorized entries and exits and no stay restrictions.

Does the Digital Nomad visa allow to have beneficiaries?

Yes, the Colombian Digital Nomad Visa allows beneficiaries economically dependent on the visa holder to apply for a visa.

The ones who can apply for the Beneficiary visa are the Spouse or permanent partner and children up to 25 years of age or who have any physical or mental disability.

What are the costs of the Digital Nomad Visa?

What should I keep in mind for a successful application?

We recommend that the documents that are issued abroad have the complete legalization chain to avoid delays in the process, that is to say, that they are updated, signed, authenticated, apostilled, and finally translated into Spanish in case they are in another language because although it is not required from the beginning of the process, the Colombian government may need it, besides this is a factor that can contribute to the probability of success.

On the other hand, if you are in Colombia, we also suggest starting the process at least two months before your stay in the country expires. Since the government’s response may sometimes take more than 30 days, there may be requirements involving the need for the apostille of foreign documents, which could extend the time of the process, so it is essential to avoid an illegal stay.

Let your processes in expert hands

With more than ten years of experience and nearly 3000 visas approved at expatgroup.co, we make sure to carry out processes with professionalism, quality, and attention to detail to achieve successful results.

Consult with our experts, and we will guide you through the process of collecting documents. We make the visa application, we are attentive to any government requirements, and we help you apply for your foreigner identification card (cédula de extranjería).

With more than 10 (ten) years of experience and more than 2,800 visas processed in expatgroup.co, we ensure that your process is carried out professionally and with great attention to detail under the highest quality standards and the Ministry of Foreign Affairs requirements, thus increasing the chances of success in your application process.

We encourage you to consult with our experts. We have experience in digital nomad visas with successful processes, where expats recommend us. We invite you to watch Josep Manier’s testimony and experience with our service.

Comments

Share your experience or question.

Your comment could inspire and help others who dream of living in Colombia.