Table of Contents

Colombia has become a key destination for foreigners who wish to start a business or establish themselves professionally, and in this context, the Registro Único Tributario (RUT) is essential. This document facilitates tax identification and is crucial for opening bank accounts and complying with tax obligations. The RUT is much more than a number; it is a key that opens the doors to Colombia’s business and finance world.

In expatgroup.co, our foreign clients must know simply and directly what the RUT is and how they can obtain it. We will detail each part of the RUT form and the steps to process it in person and online. We aim to help foreigners understand and navigate the Colombian tax system efficiently, ensuring a successful integration.

What is the RUT?

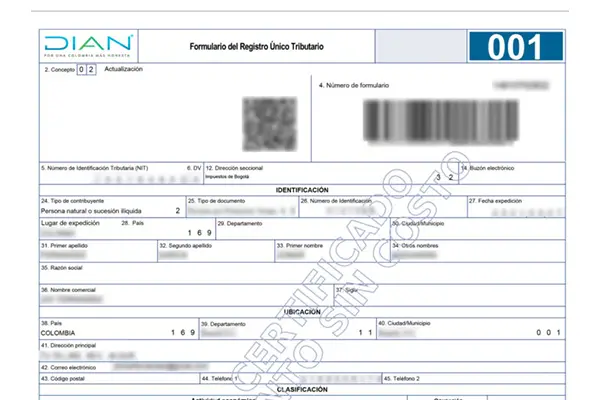

The Registro Único Tributario, or RUT, is an essential tool in Colombia’s tax structure for citizens and foreigners who wish to engage in economic activities within the territory. This document, issued by the National Tax and Customs Directorate (DIAN), functions as a tax identification that assigns a unique number to each taxpayer, whether natural or legal.

The RUT compiles vital information for significant tax and business purposes. It is the system the DIAN uses to identify, locate, and classify the function of individuals and entities within the tax system based on their economic and commercial activity, assets, contributions, and consumption.

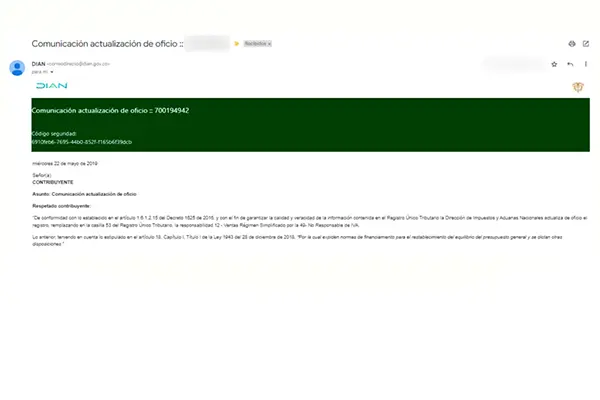

The RUT requires regular updates in case of changes in the taxpayer’s information or economic activity. You can update it by registering on the DIAN’s Muisca page, where all taxpayers can change their RUT and access their tax returns.

For foreigners in Colombia, obtaining the RUT is crucial to integrating into the economic system and complying with local regulations.

What are the benefits of obtaining the RUT for foreigners?

The Registro Único Tributario (RUT) is much more than a simple administrative requirement in Colombia; it is a tool that offers numerous benefits for foreigners residing in the country. Here are some of the critical advantages of having the RUT:

What documents are required to obtain the RUT as a foreigner?

How to obtain the RUT as a foreigner?

Registering in the Single Tax Registry (RUT) in Colombia as a foreigner may initially seem complicated, but with the correct information and preparation, you can complete it efficiently, either in person or virtually.

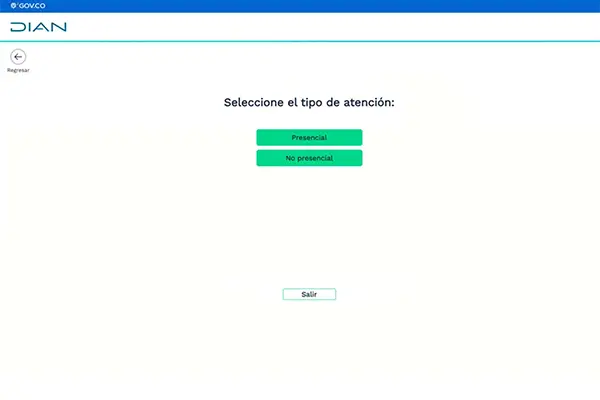

Go to DIAN's official website

Click on “Agenda una cita.” (Schedule Appointment Here).

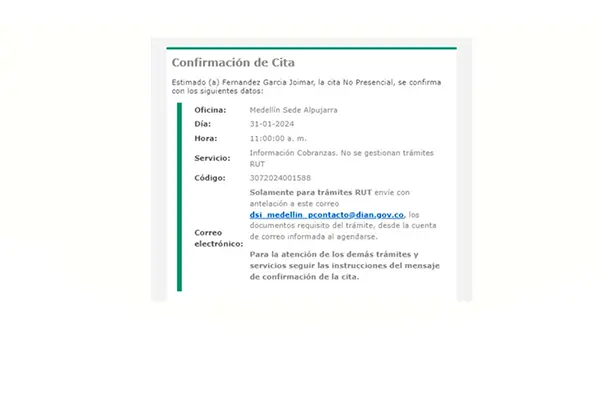

Confirmation and attendance

After your appointment has been scheduled, you will receive a confirmation email containing the email address to which you must send the required documents. You must send the pre-filled RUT form 001 along with the necessary documents to begin the process before 9:00 a.m. on the day of your appointment.

Face-to-face appointment

If you wish to make the appointment in person, follow the same steps as for scheduling and choose the face-to-face option; select the date and place to make the appointment, presenting only a copy of your ID document and the original. We recommend you visit the center chosen at least 15 minutes before and validate your appointment.

DIAN officials speak only Spanish, so preparing yourself in this language will be essential. Consider bringing someone who can assist you with translation or seek prior advice.

Comments

Share your experience or question.

Your comment could inspire and help others who dream of living in Colombia.

2 Responses

Hello,

I am looking to obtain a RUT.

I am a US citizen.

Please advise the steps

Hi Joby, we can assist you with this process, and you can find the steps here: https://expatgroup.co/tax-id-rut-individuals/#apply-now.