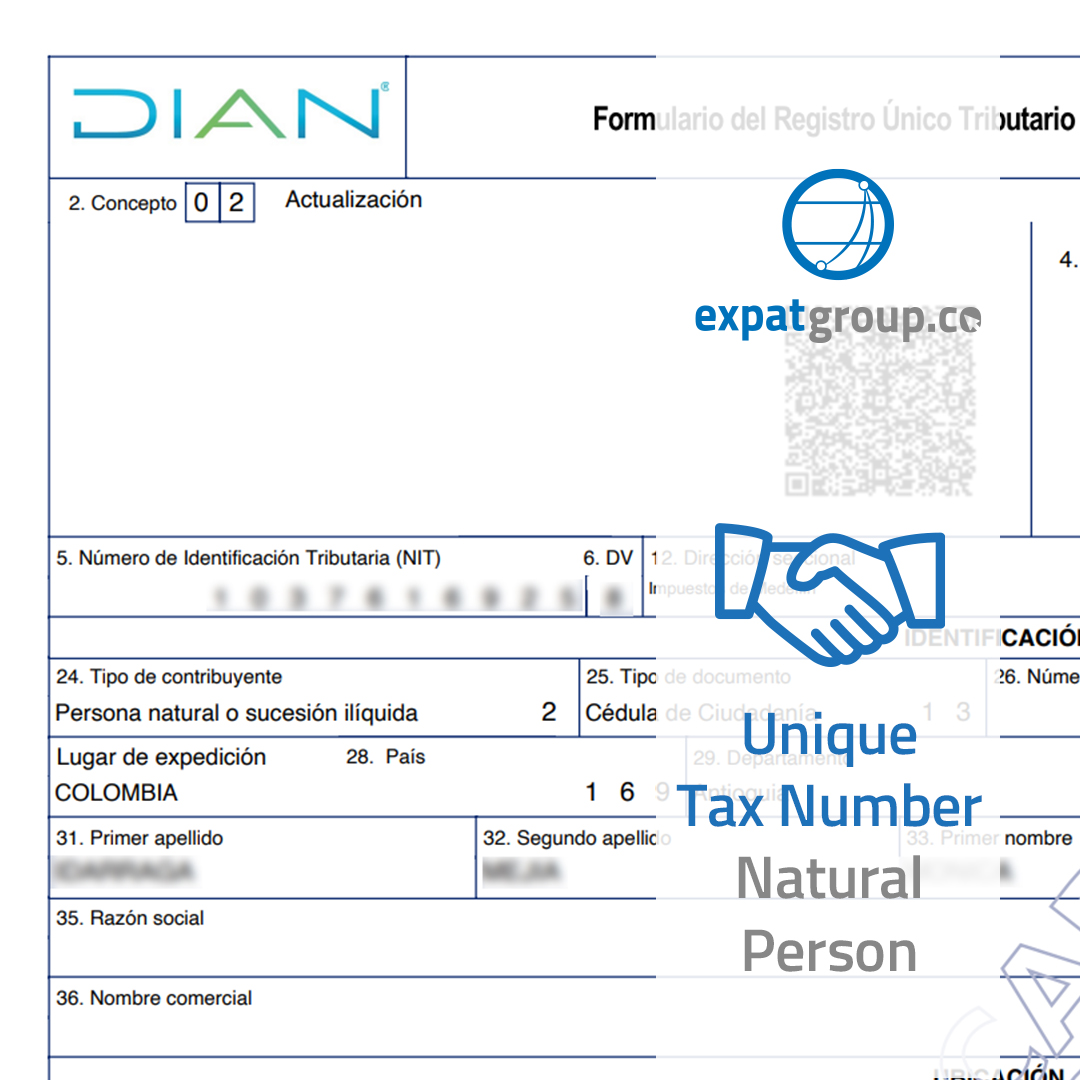

What is the RUT?

The RUT or Registro Único Tributario is the system the DIAN uses to identify, locate, and classify the function of individuals and entities within the tax system based on their economic and commercial activity, assets, contributions, and consumption.

#RUT

What documents are required to request the RUT?

Identification document

Identification document (passport, cédula de extranjería, or PEP).

Form 001

Form 001 of the Single Tax Registry (RUT).

A power of attorney

A power of attorney authenticated by a notary or consul.

Book an appoinment

Our team is prepared and ready to attend to your questions and needs. If you would like to make an appointment, click on the button to get more information.

Why should I use expatgroup.co services?

No.1 Agency in Colombia

+10 years of experience

100% online services

Quotations, advice and procedures

Professional and bilingual assistance

EXPATGROUP.CO RUT SERVICE

- Filling out the form.

- Representation before the DIAN.

- DIGITAL Certificate.

What are the valid policies for the visa?

endorsed by the Colombian government for visa applications.

Our clients recommend us

At expatgroup.co our services are designed with you in mind. That is why we have the best experts in the field for your peace of mind in the processes. We guarantee a quality service and efficiency, because we are the No. 1 agency in Colombia.

FAQs about the RUT

The Unique Tax Number (RUT) is the mechanism for the individual identification and classification of legal entities and natural persons in Colombia, allowing the determination of tax responsibilities and economic activities for each individual.

For foreigners in Colombia, obtaining the RUT can be done virtually by scheduling appointments on the web portal of the National Directorate of Taxes and Customs (DIAN).

You must provide in-person information about your work or business activities in Colombia when scheduling the appointment.

On the day of your appointment, you must submit the pre-filled RUT Form 001 and any other documentation requested by the authorities.

After scheduling your appointment, you will receive an email with the response to your request.

Note: The scheduling and appointment process is in Spanish.

Colombian authorities have established a list of individuals obliged to have an RUT:

a) Individuals and entities with the status of declarant taxpayers for income tax, complementary gains, and other taxes administered by the DIAN.

b) Autonomous patrimonies in cases where, by special provisions, they must have an Individual Tax Identification Number (NIT); note that fiduciary societies administering autonomous patrimonies for conducting foreign trade operations, in compliance with customs regulations, must register in the Unique Tax Registry – RUT for obtaining the Tax Identification Number – NIT that identifies them individually.

c) Foreign investors obliged to fulfill formal duties.

d) Branches in the country of foreign legal entities or entities.

e) Natural persons acting as legal representatives, agents, delegates, attorneys, and representatives in general who must sign declarations, submit information, and fulfill other duties on behalf of taxpayers, responsible parties, withholding agents, declarants, informants, or foreign investors, in tax, customs, or exchange matters. Likewise, auditors and accountants must comply with this registration if required by legal provisions.

f) Non-contributing individuals and entities declaring income and assets and natural and legal persons in the simplified consumption tax regime.

g) Responsible parties for the sales tax belonging to common or simplified regimes.

h) Individuals or entities not responsible for the sales tax, requiring the issuance of an NIT when, by special provisions, they are obligated to issue an invoice or as a result of the development of a non-taxed economic activity.

i) Responsible parties for consumption tax.

j) Responsible parties for the national gasoline and diesel fuel (ACPM) tax.

k) Withholding agents.

l) Importers, exporters, and other customs users.

m) Professionals buying and selling cash and traveler’s checks.

n) Those obliged to declare the entry or exit of foreign currency or legal Colombian currency in cash.

o) The DIAN may require the registration of other subjects different from those mentioned in the previous paragraphs to control of substantial and formal obligations it administers.

p) Non-resident and non-domiciled investors in Colombia holding foreign portfolio capital investments, regardless of the method or vehicle used to make the investment.

Being a foreigner does not automatically obligate or exempt you from registering for the RUT. This will depend on your activities and responsibilities in Colombia and whether you meet any of the conditions established by the tax authorities in the country. Consult our team of experts to help you understand your tax responsibilities under Colombian laws.

Any individual can register for the RUT. However, it is crucial to know and understand your tax responsibilities in the country, how to report and classify them before the authorities, and the appropriate methods for compliance. Additionally, expatgroup.co provides bilingual representation and interpretation services; you can request a quote for our services here.