Table of Contents

When applying for a Colombian visa, it is essential to have a valid health policy that guarantees medical coverage during the entire stay and complies with the requirements of the Ministry of Foreign Affairs.

Opting for a 2-year travel insurance policy is key, as a shorter policy could reduce the visa’s validity period, forcing the foreigners to make subsequent applications (also known as renewals) to extend their stay in Colombia.

In terms of required coverages, your insurance should include comprehensive medical care in Colombia, repatriation in case of accident or death, and coverage for pre-existing conditions. The latter is being requested more frequently due to constantly evolving immigration requirements and current health challenges.

In this blog, we will delve into the validity of health policies, visas that require this requirement, and coverage for pre-existing conditions. We will also explore other essential benefits that your policy must include to comply with immigration requirements in Colombia.

What is a travel health insurance policy for visas in Colombia?

Health insurance is a fundamental requirement for certain types of visas in Colombia, especially those that imply a prolonged stay in the country, such as visitor and some migrant visas. This insurance guarantees that foreigners have adequate medical coverage during their stay in Colombian territory, thus avoiding unforeseen costs that the public health system will assume.

Although it is possible to be affiliated to the Colombian public health system (EPS – Empresas Promotoras de Salud) once you obtain the Cédula de Extranjería, it is not accepted as a valid policy for visa applications. Therefore, at expatgroup.co, we inform our customers about the health requirements, helping them avoid possible rejections in their application process.

Do all visas in Colombia require a mandatory travel health insurance policy?

Not all visas in Colombia require a mandatory health insurance policy. The visas that do are the Digital Nomad Visa, Student Visa, Pensioner Visa, Investor Visa, Rentist Visa, Medical Treatment Visa, as well as other visas within the types Migrant, Visitor, and Courtesy.

Visas in Colombia that require a travel health insurance policy coverage

How long must a health insurance policy be valid for visa applications in Colombia?

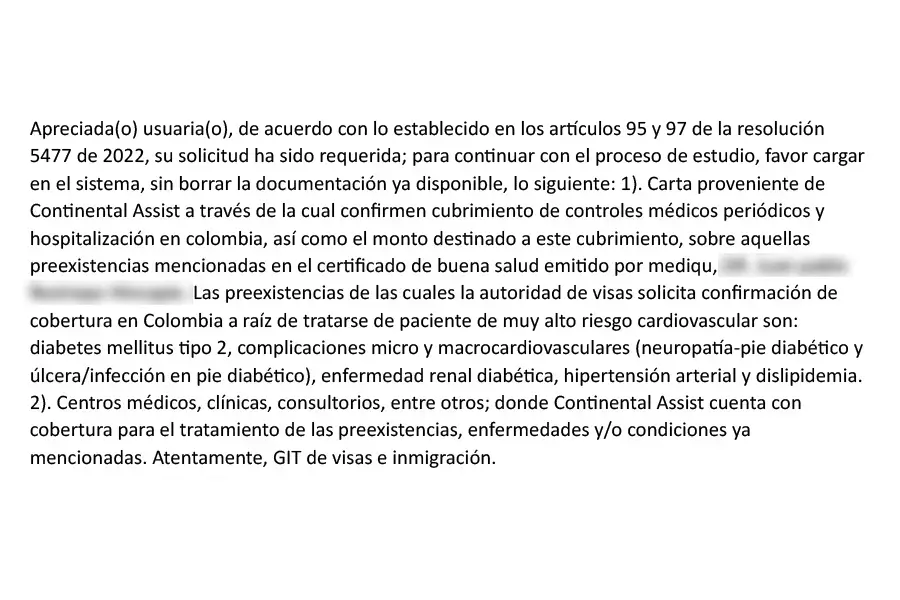

Resolution 5477 of 2022 establishes that “the validity of the health policy must coincide with the expected time of stay in the country,” as provided in the articles regulating the requirements of each visa. This means the insurance certificate must guarantee coverage for the maximum period the foreigner plans to reside in Colombia.

For example, if the visa has a maximum duration of one year, the policy must cover the same period to increase the chances that the Ministry of Foreign Affairs will grant the visa with such duration. However, it is important to note that the final visa approval time is at the discretion of the Colombian immigration authority.

Can I purchase a travel health insurance policy valid for 2 years or more?

The Ministry of Foreign Affairs requires that the insurance’s validity coincide with the maximum time of stay authorized for each type of visa. However, most insurance companies only offer policies with one year of coverage, which represents a great disadvantage for applicants and may limit the validity of the visa granted.

At expatgroup.co, we have established strategic alliances that allow us to offer policies with a validity of up to 2 years for all visas that require this maximum coverage period. In addition, for visas with more extended validity periods, such as those for retirees, investors, and freelancers, which can be granted for up to 3 years, we have insurance options tailored to these terms. This significantly increases the likelihood of obtaining visa approval for the maximum possible duration.

With an adequate health policy, you can avoid setbacks in your visa application and ensure compliance with immigration requirements. Consult with our experts to get the ideal coverage for your immigration process in Colombia.

Travel Insurance with 2 Years of Coverage

Ensure your stay in Colombia with a policy that meets immigration requirements.

🔹 Comprehensive medical coverage

🔹 Repatriation and emergency assistance

🔹 Valid for visa

What is the maximum age to purchase a health insurance policy?

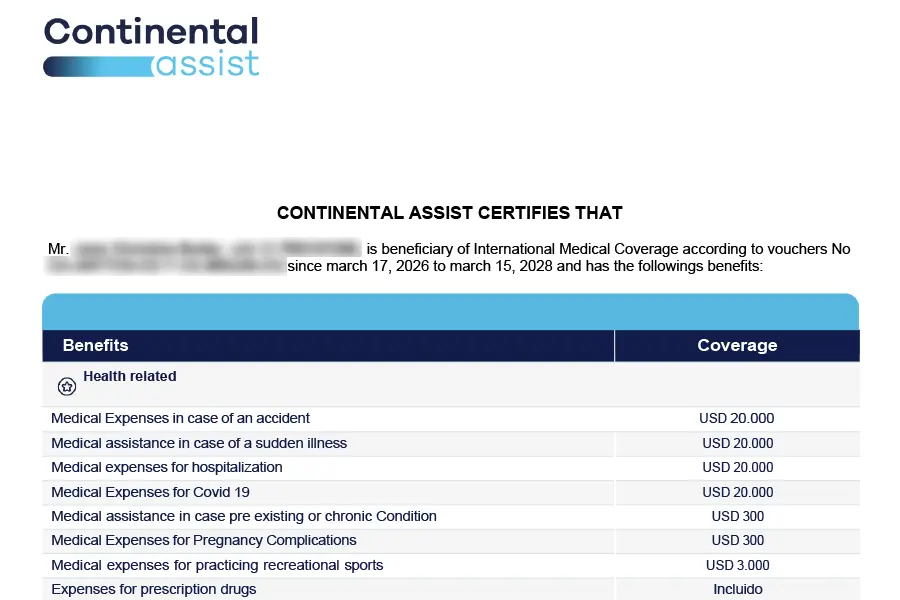

Age is a key factor when purchasing health insurance, as many insurers impose age limits on the purchase of new policies. As a person ages, options may become fewer and costs tend to increase, but there are still alternatives designed for different stages of life. Below is a table of the plans available from Continental Assist, organized by the insured’s age.

| Age range restriction | Continental Assist |

|---|---|

| Plans with no age restriction | Not available |

| Age range 0 to 75 years | Global Plan, Total Plan, Maximus Plan and Supreme Plan |

| Age range 75 to 85 years | Total Max Plan and Maximus Max Plan |

What are pre-existing conditions and why should my health insurance policy include them?

Pre-existing conditions are medical conditions, chronic illnesses, or injuries diagnosed prior to the contracting of a health policy. These may include hypertension, diabetes, and heart disease, among others. In the insurance field, many companies exclude coverage for treatments related to these illnesses, which can represent a financial and health risk for the customer.

When applying for a visa in Colombia, having a policy that includes coverage for pre-existing conditions is essential. This guarantees access to medical attention without restrictions if treatment is required for an existing condition. In addition, the Ministry of Foreign Affairs has increased the requirements for medical insurance so that comprehensive coverage can be decisive in the visa’s approval.

Choosing a policy with coverage for pre-existing conditions provides greater security and stability during your stay in Colombia. Before contracting an insurance policy, it is advisable to verify that it covers all the conditions required by the immigration authorities.

Essential coverages that should be included in your travel health insurance policy for visas in Colombia

To comply with the requirements of the Ministry of Foreign Affairs and guarantee comprehensive protection during your stay in Colombia, your health policy must include the following coverage:

Coverage required by the Ministry of Foreign Affairs

Medical coverage for accidents and illnesses

Coverage of consultations, hospitalization, surgeries, and necessary treatments due to accidents or illnesses.

Medical or funeral repatriation

Covers the transfer to the country of origin and prevents the Colombian State from assuming costs in case of death or for medical reasons.

Emergency medical transfers

Necessary to ensure care in case of medical emergencies requiring transportation to a specialized center.

Other recommended coverages for greater protection

Coverage for pre-existing conditions

Protection against medical conditions diagnosed before contracting the insurance, avoiding unexpected expenses.

Hotel expenses for forced rest following hospitalization

Financial support if out-of-hospital recovery is required before travel.

Medical evacuation in extreme cases

Ensures transfer to a specialized facility if the required care is not available at the current location.

Online medical consultation (Telemedicine)

Access to medical care without the need to travel to a health center.

Coverage for outpatient and inpatient drugs

Includes the cost of drugs prescribed during a consultation or hospitalization.

Emergency dental care

Covers immediate treatment for pain or unforeseen dental problems.

Choosing travel insurance is essential to ensure medical assistance and coverage in case of unforeseen events, as well as to comply with visa requirements in Colombia.

To sum up

Obtaining a visa in Colombia requires compliance with several requirements, and the travel health insurance policy is one of the most important for certain types of visas. Immigration regulations establish that the insurance’s validity must coincide with the maximum authorized period of the visa, which can be a challenge since most insurers only offer coverage for one year.

Thanks to our strategic alliances, expatgroup.co offers policies with validity periods of up to 2 years and customized options for visas with extended validity periods, such as those for pensioners, investors, and freelancers. Having adequate insurance facilitates visa approval and guarantees medical protection during the entire stay in Colombia.

f you plan to apply for a visa in Colombia, make sure you take out a policy that meets the Ministry of Foreign Affairs requirements, including comprehensive medical coverage, health repatriation, and care for pre-existing conditions. This will give you peace of mind and prevent setbacks in your immigration process.

Do you want to obtain travel health insurance with Continental Assist?

At expatgroup.co, we understand the importance of having a proper insurance policy. That’s why, we invite you to fill out the form to receive the guide on purchasing Travel Health Insurance with Continental Assist.

Comments

Share your experience or question.

Your comment could inspire and help others who dream of living in Colombia.

3 Responses

“Although it is possible to be affiliated to the Colombian public health system (EPS — Empresas Promotoras de Salud) once you obtain the Cédula de Extranjeria, it is not accepted as a valid policy for visa applications.”

Thank you for your this article. I intend to affiliate to EPS after getting my cedula. Can you write an article or leave a comment on how I can estimate my monthly cost of EPS as a pensioner earning approximately $2,000 per month? Also, if I eventually decide to marry my Colombian girlfriend at some point after getting my visa, can I qualify to be a dependent on her EPS?

“Although it is possible to be affiliated to the Colombian public health system (EPS — Empresas Promotoras de Salud) once you obtain the Cédula de Extranjeria, it is not accepted as a valid policy for visa applications.”

Thank you for your this article. I intend to affiliate to EPS after getting my cedula. Can you write an article or leave a comment on how I can estimate my monthly cost of EPS as a pensioner earning approximately $2,000 per month? Also, if I eventually decide to marry my Colombian girlfriend at some point after getting my visa, can I qualify to be a dependent on her EPS?

To help you estimate your monthly EPS costs as a pensioner, we recommend checking out the following blog. It provides examples that clarify the formula used to determine your payment amount.

However, you need to keep in mind that if you’re a holder of a Colombian Retirement Visa, you CAN’T enroll into an EPS.

🌐https://expatgroup.co/blog/how-to-contribute-to-social-security-in-colombia-if-you-are-a-foreigner/

On the other hand, if you eventually marry your Colombian girlfriend after obtaining your visa, yes — you can qualify to be a beneficiary (dependent) under her EPS if she is employed or contributing independently. This could exempt you from paying EPS contributions separately.

Anyway, feel free to reach out to us directly if you’d like help to estimate your EPS cost or understand your options once married with confidence and the best advice:

📲 https://wa.me/19547993692